Best Forex

Brokers in 2025

We've tested over 80 forex brokers to help you find the perfect

trading platform.

- 80+ Brokers Tested

- 1,000+ Data Points Analyzed

- Independent Reviews

- Updated October 2025

Top Forex Brokers Compared

Our comprehensive comparison of the best forex brokers based on spreads,

regulation, platforms, and overall trading experience.

Rank

Broker

Min. Deposit

EUR/USD Spread

Regulation

Platform

Score

Action

#2

Pepperstone

(4.8)

$200

0.6 pips

MT4, MT5, cTrader, TradingView

9.6 /10

#4

FP Markets

(4.7)

$100

0.0 pips

MT4, MT5, cTrader, WebTrader, IRESS

9.3 /10

#7

ModMount

(4.6)

$100

2.5 pips

Proprietary web-based, mobile, desktop apps

9.1 /10

#9

AvaTrade

(4.6)

$100

0.9 pips

MetaTrader 4, MetaTrader 5, AvaTrade proprietary, WebTrader, Mobile Apps

9.1 /10

#10

FXNovus

(4.6)

$100

2.5 pips

Proprietary WebTrader platform (Web-based)

9.1 /10

Detailed Broker Reviews

In-depth analysis of our top-rated forex brokers, tested and reviewed by our expert

team.

#1

IC Markets

Best Overall Forex Broker

Why We Chose IC Markets

IC Markets consistently delivers industry-leading tight spreads, lightning-fast execution, and robust regulation across multiple jurisdictions. With a track record spanning over 15 years, they've built a reputation for reliability and transparency that's hard to match.

- Pros

- Ultra-tight spreads starting from 0.0 pips on Raw Spread accounts

- True ECN broker with direct market access

- Regulated by top-tier authorities (ASIC, CySEC)

- No dealing desk intervention

- Excellent platform variety (MT4, MT5, cTrader)

- 24/7 customer support in multiple languages

- Cons

- Higher minimum deposit than some competitors

- Limited educational resources for beginners

- No proprietary platform

Who Is IC Markets Best For?

Professional traders and scalpers who prioritize execution speed and tight spreads

#2

Pepperstone

Best for Active Traders

Why We Chose Pepperstone

Pepperstone stands out with zero minimum deposit, competitive spreads, and exceptional platform integration including TradingView. Their commitment to transparency and trader education makes them ideal for serious traders.

- Pros

- No minimum deposit requirement

- Top-tier regulation across FCA, ASIC, and CySEC

- TradingView integration for advanced charting

- Competitive spreads and low commissions

- Fast execution with minimal slippage

- Strong educational resources and market analysis

- Cons

- Inactivity fee after 12 months

- Limited cryptocurrency offerings

- Customer support can be slow during peak times

Who Is Pepperstone Best For?

Active traders who value platform flexibility and don't want deposit minimums

#3

XM Group

Best for Beginners

Why We Chose XM Group

XM Group's micro account with just $5 minimum deposit, combined with comprehensive educational resources and generous bonuses, makes it the perfect starting point for new traders.

- Pros

- Ultra-low $5 minimum deposit on micro accounts

- Excellent educational content and webinars

- No deposit or withdrawal fees

- Multiple account types for different experience levels

- Strong bonus program for new traders

- Multi-lingual 24/7 support

- Cons

- Wider spreads compared to ECN brokers

- Limited advanced tools for professional traders

- Bonus terms can be restrictive

Who Is XM Group Best For?

Beginner traders looking to start with minimal capital and comprehensive learning resources

#4

FP Markets

Best for MetaTrader & Algo Trading

Why We Chose FP Markets

FP Markets delivers low-cost, efficient trading, especially for forex and CFD traders, with tight spreads, fast execution, and a broad platform selection. With a 15-year track record as a reputed broker, FP Markets offers a comparatively safe option for traders. The broker provides a great variety with over 10,000 CFD products.

- Pros

- Ultra-low minimum deposit

- Exceptional spreads

- Outstanding platform variety

- Strong multi-tier regulation

- Excellent customer satisfaction

- Extensive product range

- Award-winning broker

- Cons

- Limited educational resources

- IRESS platform fees

- Limited investment products

Who Is FP Markets Best For?

Forex and CFD traders seeking competitive pricing, excellent execution speed, and multiple platform options with a low barrier to entry.

#5

eToro

Best Social & Copy Trading Platform

Why We Chose Pepperstone

eToro has built a community of 35 million users , making it the world's leading social trading platform. eToro expertly merges self-directed trading and copy trading under a unified trading experience, allowing traders to copy the trades of experienced investors or receive exclusive perks for sharing their own trading strategies. Using award-winning, cutting-edge technology, CopyTrader allows you to view what real investors are doing in real time and copy their investment strategy automatically.

- Pros

- Revolutionary social trading

- Massive global community

- Very low barrier to entry

- Strong multi-jurisdiction regulation

- User-friendly proprietary platform

- Diverse asset classes

- Cons

- Higher spreads than competitors

- Additional fees can accumulate

- No MT4/MT5 support

- Withdrawal fees

Who Is Pepperstone Best For?

Beginner investors and social traders who want to learn from and copy experienced traders in a community-driven environment.

#6

Savexa

Best for Flexible Leverage Trading

Min Deposit

$250

Spreads From

2.5 pips

Platforms

Proprietary web-based, mobile, desktop apps

Regulation

Why We Chose Savexa

Savexa offers over 160 tradable assets including CFDs on Forex, commodities, indices, stocks, cryptocurrencies, and metals. The broker provides multiple account types—Classic, Silver, Gold, Platinum, and VIP—each designed to meet varying trading needs while offering leverage up to 1:400.

- Pros

- High leverage availability

- Extensive asset selection

- Integrated market analysis

- Multiple account tiers

- Negative balance protection

- Round-the-clock support

- User-friendly platform

- First withdrawal fee-free

- Cons

- Higher minimum deposit

- No MT4/MT5 support

- Slower withdrawal processing

- Limited regulatory oversight

- Wider spreads on lower tiers

Who Is Savexa Best For?

Traders who prefer active trading with flexible account settings

#7

ModMount

Best for Active Traders

Min Deposit

$250

Spreads From

2.5 pips

Platforms

Proprietary web-based, mobile, desktop apps

Regulation

Why We Chose ModMount

ModMount stands out as a user-friendly trading broker with a modern, proprietary trading platform featuring embedded Trading Central services and one-click trading. It offers competitive leverage up to 1:400, an asset selection covering over 350 instruments, including Forex, commodities, indices, shares, futures, and cryptocurrencies.

- Pros

- User-friendly proprietary platform with Trading Central integration

- One-click trading for speed and ease

- Wide range of 350+ trading instruments

- Leverage up to 1:400 with negative balance protection

- Multilingual 24/7 customer support

- Commission-free Forex trading

- Cons

- Offshore regulation rather than Tier 1 jurisdiction

- No support for US clients or ECN accounts

- Limited proprietary educational resources

Who Is Pepperstone Best For?

Manual CFD traders, day traders, and intermediate to professional traders worldwide.

#8

Mirrox

Best for Diverse Asset Trading

Min Deposit

$250

Spreads From

2.5 pips

Platforms

Proprietary WebTrader platform (Web-based)

Regulation

Why We Chose Mirrox

Mirrox offers access to over 160+ tradable assets including CFDs on Forex, commodities, indices, stocks, and cryptocurrencies. The platform is designed with advanced tools and extensive resources to support informed trading decisions. With a web-based interface, traders can access financial markets from any device with an internet connection, providing flexibility and convenience for global trading.

- Pros

- Ultra-low $5 minimum deposit on micro accounts

- Excellent educational content and webinars

- No deposit or withdrawal fees

- Multiple account types for different experience levels

- Strong bonus program for new traders

- Multi-lingual 24/7 support

- Cons

- Wider spreads compared to ECN brokers

- Limited advanced tools for professional traders

- Bonus terms can be restrictive

Who Is Pepperstone Best For?

Beginner investors and social traders who want to learn from and copy experienced traders in a community-driven environment.

#9

AvaTrade

Best for Regulated Multi-Platform Trading

Why We Chose AvaTrade

AvaTrade is a highly regulated, globally recognized broker with a strong reputation for reliability and security. Its diverse offerings include multiple account types suitable for novice to professional traders, a variety of trading platforms including MetaTrader 4/5 and proprietary platforms, and a broad asset base covering Forex, CFDs, commodities, indices, cryptocurrencies, and more.

- Pros

- Regulated by multiple Tier-1 authorities

- Low $100 minimum deposit accessible for most traders

- Wide platform choice including MT4, MT5, and proprietary platforms

- Comprehensive asset offering including

- Flexible account types including Islamic and professional accounts

- No withdrawal fees and multiple deposit options

- Cons

- Geographic restrictions apply to some deposit methods

- Spreads can widen during high volatility

- Crypto trading is not available on all account types

Who Is AvaTrade Best For?

AvaTrade is ideal for beginner to professional traders worldwide seeking a well-regulated broker with versatile trading platforms and assets

#10

FXNovus

Best Overall Forex Broker

Min Deposit

$250

Spreads From

2.5 pips

Platforms

Proprietary WebTrader platform (Web-based)

Regulation

Why We Chose FXNovus

FXNovus is a relatively new broker, established in 2020, and regulated by the FSCA in South Africa. It offers over 160 CFDs on various assets, including forex, cryptocurrencies, indices, stocks, and commodities, with a focus on providing a secure trading environment.

- Pros

- Extensive language support

- High leverage availability

- Diverse asset selection

- Multiple account tiers

- 24/7 customer support

- Multiple deposit options

- Cons

- High spreads across all instruments

- No MT4/MT5 support

- Inactivity fees

Who Is FXNovus Best For?

Traders seeking multi-language support and high leverage options who are comfortable with moderate risk

How We Test & Review Forex Brokers

Our rigorous testing methodology ensures unbiased, comprehensive reviews. We've spent over

1,600 hours testing brokers to bring you reliable, accurate information.

Our Testing Process

01

Regulation Verification

We verify licenses with regulatory bodies and check each broker's compliance history.

02

Platform Testing

20+ hours of hands-on testing per broker across multiple platforms and devices.

03

Cost Analysis

Live spread monitoring across major pairs and comprehensive fee structure analysis.

04

Customer Support Testing

Multi-channel support testing with complex queries at various times.

05

Deposit/Withdrawal Testing

Real money testing of funding methods, processing times, and fee transparency.

06

Scoring & Ranking

Comprehensive evaluation across all criteria to determine final rankings.

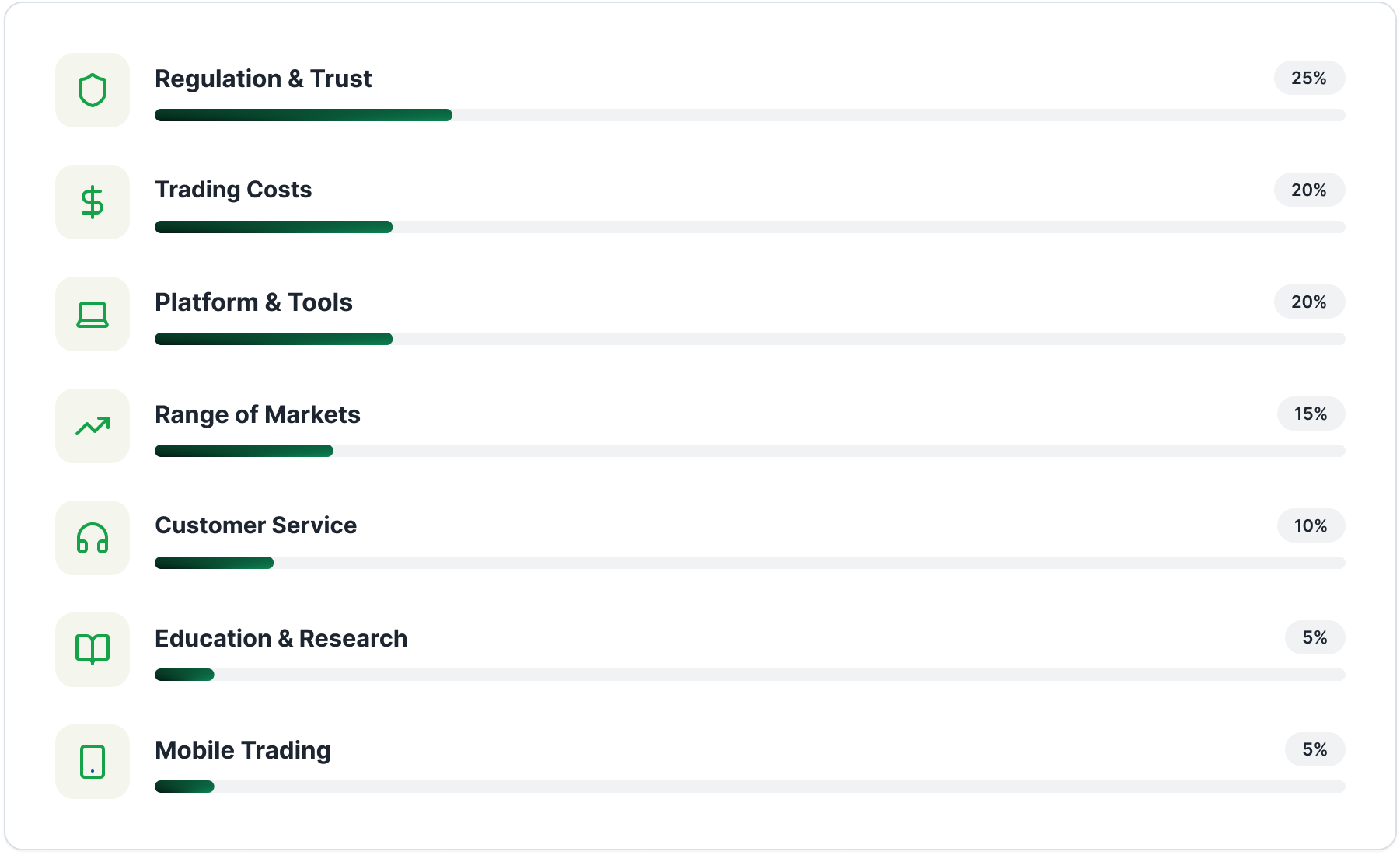

Rating Criteria Breakdown

Our Expert Team

Our reviews are conducted by a team of experienced traders and financial analysts with over 40 years of combined

experience in forex markets. We maintain strict editorial independence and are committed to providing unbiased,

data-driven recommendations.

Forex Broker Selection Guide

Essential information to help you choose the right forex broker for your trading

needs.

What Is a Forex Broker?

A forex broker is a financial services company that provides traders access to the foreign exchange market. They act as intermediaries between retail traders and the interbank forex market, offering trading platforms, market access, leverage, and various tools to facilitate currency trading.

Forex brokers make money primarily through spreads (the difference between buy and sell prices) or commissions on trades. They may also earn from overnight financing charges (swaps) and, in some cases, from trading against their clients (market makers), though reputable brokers typically operate as ECN/STP brokers that route orders directly to liquidity providers.

Why Regulation Matters

Regulation is the most important factor when choosing a forex broker. Regulated brokers must adhere to strict financial standards, maintain segregated client accounts, and provide investor protection schemes. This ensures your funds are safe and the broker operates fairly.

Tier 1 Regulators (Highest Standards)

- FCA (UK) - Financial Conduct Authority, strict capital requirements, FSCS protection up to £85,000

- ASIC (Australia) - Australian Securities and Investments Commission, strong oversight

- CFTC/NFA (US) - Commodity Futures Trading Commission & National Futures Association, most stringent

- CySEC (Cyprus) - Cyprus Securities and Exchange Commission, EU-compliant

Tier 2 Regulators (Moderate Standards)

- FSCA (South Africa), FSA (Japan), FINMA (Switzerland)

Warning About Unregulated Brokers

Never trade with unregulated brokers. You have no legal protection if they mishandle your funds, manipulate prices, or refuse withdrawals. The risk of fraud is extremely high.

Understanding Forex Trading Costs

Spreads

The difference between the buy and sell price. Lower is better. Typical EUR/USD spreads range from 0.0-1.5 pips. ECN/Raw Spread accounts offer the tightest spreads but charge commissions.

Commissions

Some brokers charge a fixed commission per lot instead of wider spreads. For example, $7 per round turn (open + close) on a standard lot. This is common with ECN accounts.

Overnight Fees (Swaps)

Interest charged or earned for holding positions overnight. Based on the interest rate differential between the two currencies. Can be positive (you earn) or negative (you pay).

Hidden Fees to Watch For

Inactivity fees, withdrawal fees, deposit fees (especially credit cards), currency conversion fees, and account maintenance fees. Always read the fee schedule carefully.

Trading Platform Options

MetaTrader 4 (MT4)

The industry standard, known for reliability, extensive indicator library, and automated trading (Expert Advisors). Best for: Traditional forex traders, algo traders, those who value simplicity.

MetaTrader 5 (MT5)

The successor to MT4 with more timeframes, order types, and multi-asset capabilities. Best for: Multi-asset traders, those wanting more advanced features.

cTrader

Modern, intuitive platform with advanced charting and Level II pricing. Best for: Scalpers, day traders, those who prefer clean UI.

TradingView

Web-based platform with social features and advanced charting. Some brokers integrate it for order execution. Best for: Chart analysis, social traders.

Leverage & Margin Explained

Leverage allows you to control positions larger than your account balance. For example, with 100:1 leverage, you can control $100,000 with just $1,000. While this amplifies potential profits, it equally amplifies losses.

How Leverage Works

If you have $1,000 and use 100:1 leverage to open a $100,000 position, a 1% move equals $1,000 profit or loss— 100% of your account. This makes forex trading high-risk.

Regional Restrictions

US: Max 50:1 (major pairs), EU: Max 30:1 (ESMA rules), Australia: Max 30:1 (retail), Offshore brokers may offer higher leverage but with less protection.

Risk Warning: 70-80% of retail forex accounts lose money. Only use leverage you understand and can afford to lose.

Ready to Start Trading?

After reviewing 80+ brokers, we recommend starting with IC Markets for their unbeatable combination of tight spreads, robust regulation, and professional-grade execution. Whether you're a beginner or experienced trader, choosing a regulated broker with transparent costs is crucial for long-term success.

FAQs

Are forex brokers regulated?

Yes, reputable forex brokers are regulated by official financial authorities to ensure transparency, fairness, and the protection of traders' funds. Regulation means the broker must comply with strict rules on client fund segregation, capital requirements, and reporting standards. Well-known regulators include the FCA (UK), CySEC (Cyprus), ASIC (Australia), and NFA (USA). Always check a broker's license number and verify it on the regulator's official website before opening an account.

How much money do I need to start forex trading?

The minimum amount required to start forex trading depends on the broker and the account type you choose. Many brokers allow you to start with as little as $100–$250, while others may require more for premium accounts. However, your starting capital should also reflect your trading goals and risk tolerance—starting small and gradually scaling up as you gain experience is generally recommended.

What are spreads in forex trading?

A spread is the difference between the bid (buy) and ask (sell) price of a currency pair. It represents the broker's fee for executing your trade. For example, if EUR/USD has a bid price of 1.1000 and an ask price of 1.1002, the spread is 2 pips. Lower spreads are typically better for traders, especially those who trade frequently, as they reduce overall trading costs.

Is forex trading legal in my country?

Forex trading is legal in most countries, but regulations vary depending on the jurisdiction. Some countries have fully regulated forex markets, while others impose restrictions or require traders to use licensed local brokers. It's important to confirm local regulations and trade only with regulated brokers that accept clients from your country.

What's better: MT4 or MT5?

Both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are powerful trading platforms developed by MetaQuotes.

MT4 is widely used, known for its simplicity, and ideal for forex traders who rely on technical analysis and automated trading (via Expert Advisors).

MT5 offers enhanced features, including more timeframes, additional order types, a built-in economic calendar, and broader access to other markets like stocks and commodities.

Your choice depends on your trading style—if you only trade forex, MT4 is sufficient; for multi-asset trading, MT5 may be better.

Do I need to pay taxes on forex trading?

Yes, in most countries, profits from forex trading are subject to taxation, though the type and rate of tax vary by jurisdiction. Forex income may be classified as capital gains, income, or speculation-based earnings. It's best to consult a tax professional in your country to understand your specific obligations and ensure compliance with local laws.

How do I avoid forex scams?

To avoid forex scams:

Trade only with regulated brokers licensed by recognized authorities.

Verify broker credentials on official regulatory websites.

Avoid unrealistic promises, such as guaranteed profits or "secret" trading systems.

Check reviews and ensure the broker has a transparent history and accessible customer support.

Withdraw funds early to test how reliable and efficient the process is.

Can I start forex trading with $100?

Yes, you can start trading forex with as little as $100, especially with brokers that offer micro or cent accounts. However, trading with a small balance requires strict risk management—using low leverage, setting stop-losses, and focusing on education. Starting small is a great way to learn the market without taking on excessive risk.

What is leverage in forex?

Leverage allows traders to control larger positions with a smaller amount of capital. For example, with 1:100 leverage, you can control $10,000 worth of currency with just $100 of your own funds. While leverage can amplify profits, it also increases potential losses, so it should be used carefully. Always understand the risks and the margin requirements set by your broker before trading with leverage.